The recent upturn in investor confidence in Oscar Health is indicative of a strong convergence of market pragmatism, digital-first innovation, and healthcare reform. Shares are currently trading at about $14.69, far below the peak of $23.79 from the previous year, but they are exhibiting a slight upward trend that has raised some cautious optimism. When viewed through a long-term perspective by seasoned investors, Oscar’s repositioning feels a lot like a phoenix moment—burned but not broken.

Oscar’s financials have significantly improved over the last quarter. In Q1 2025, revenue reached $3.05 billion, up over 42% from the same time the previous year. Under the new leadership, net income also increased by more than 55%, indicating a very effective use of capital. The business has started to operate not only as an insurer but also as a provider of tech infrastructure by relying on its exclusive +Oscar platform, quietly licensing its technology to other healthcare organizations. This change is not only wise, but it also works incredibly well to diversify revenue sources and position Oscar as a back-end powerhouse.

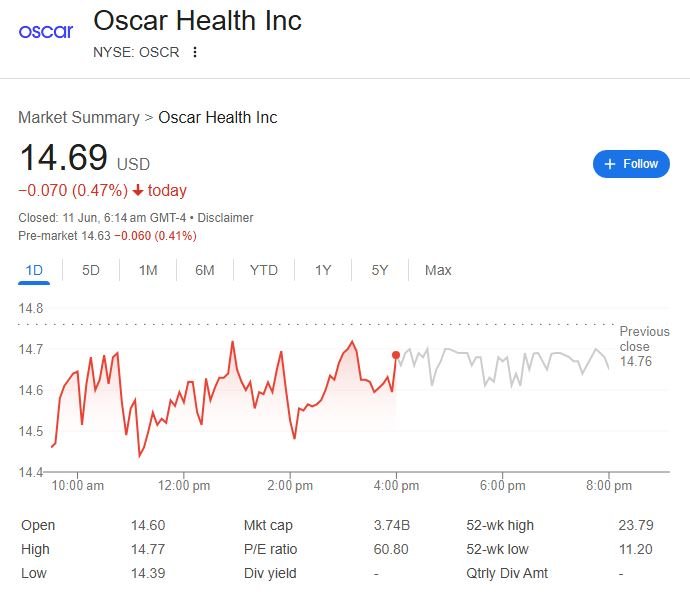

Key Information About Oscar Health, Inc. (OSCR)

| Company Name | Oscar Health, Inc. |

|---|---|

| Stock Symbol | NYSE: OSCR |

| Current Price | $14.69 (Pre-market: $14.63) |

| 52-Week Range | $11.20 – $23.79 |

| Market Capitalization | $3.74 Billion |

| P/E Ratio (TTM) | 60.80 |

| Latest Quarterly Revenue | $3.05 Billion (Q1 2025) |

| Net Income (Q1 2025) | $275.27 Million |

| EPS (Q1 2025) | $0.92 (up 48.39% year-over-year) |

| CEO | Mark Bertolini (since April 3, 2023) |

| Headquarters | New York City, United States |

| Year Founded | 2012 |

| Founders | Joshua Kushner, Mario Schlosser, Kevin Nazemi |

In April 2023, Oscar was replaced by Mark Bertolini, who previously led Aetna through a $69 billion merger with CVS. His influence has been especially helpful in ensuring that Oscar’s goals are based on sound financial principles. The brand was once thought to be too Silicon Valley for Wall Street’s tastes, but Bertolini’s arrival has softened that perception by substituting cautious growth for aggressive expansion. Oscar has subtly restored its once-diffused credibility through tightened operations and strategic alliances.

Oscar has become more like Palantir or ServiceNow than traditional health insurers by establishing itself as a technology enabler for hospital systems and insurers. Its dual identity as a digital platform and a policy provider makes it extremely adaptable in a market that is hungry for quick fixes in the healthcare industry. Oscar’s increasing earnings per share (0.92 as of Q1) demonstrate that strategic shift, which investors are starting to notice.

Oscar was frequently grouped with health-tech aspirants such as Clover Health and Alignment Healthcare in the early 2020s. As investors demanded results, many of these companies that had flourished during the telehealth boom fell. Oscar was also viewed with suspicion. Surprisingly, though, the business now leads with outcomes rather than words. The company has demonstrated its worth by exceeding Wall Street earnings projections by almost 14% and achieving a positive net margin of over 9%.

Oscar Health’s public interest frequently lags behind the news cycles surrounding its well-known co-founder, Joshua Kushner. His family’s political ties have occasionally raised questions, but they have also increased his visibility. However, the company’s current tone has been redefined by Mark Bertolini’s composed leadership. Oscar now communicates through quarterly calls, open earnings reports, and remarkably stable margins rather than relying on hype.

Oscar’s consumer-first approach to healthcare is indicative of the way Americans are increasingly choosing to communicate with their insurers—through apps, real-time data, and simplified services. The company’s interface, which resembles a banking platform rather than a pile of bureaucratic forms, is incredibly clear and easy to use. Large legacy firms frequently ignore these details, which give Oscar a surprisingly low operational cost. Customer support expenses decrease with an intuitive user experience—a feedback loop that is remarkably effective.

The low beta of Oscar (0.40) provides additional comfort for early-stage investors who are still undecided. Low-volatility assets are extremely valuable in a volatile market. Its P/E ratio of 60.80 may appear high, particularly when compared to more established healthcare stocks like Molina or Centene, but it represents expected growth from new tech-driven healthcare business models. A company’s valuation starts to seem reasonable when it outperforms EPS by double digits.

When Oscar releases its Q2 earnings on August 7, 2025, it will face its next significant test. Analysts anticipate revenue of $2.87 billion and earnings per share of $0.35. Overcoming those projections would probably be a clear indication that the upward trend is not only steady but also accelerating. The stock has dropped by almost 26% in the last year, but this might be more a result of sector-wide volatility than internal errors. The recovery now appears to be particularly resilient, supported by better cash flows, higher margins, and a more devoted clientele rather than by investor sentiment.

Oscar is creating what may soon resemble a healthcare operating system through licensing agreements and insurance expansion. The business accesses a scalable, recurring revenue model by using its AI tools and data analytics for outside partners. In a sector known for its sluggish adoption of technology, this is especially inventive. Oscar may outgrow the narrow category it was previously assigned if it can continue to play the roles of both platform and insurer.

Oscar gained trust during the pandemic thanks to its quick enrollment and virtual care strategies. It demonstrated exceptional dependability during a national emergency by combining behavioral tools and digital triage. Its enhanced financial standing and goodwill have created a basis for long-term relevance.

Oscar’s foundation will become a competitive advantage in the upcoming years as AI continues to revolutionize workflow automation and healthcare diagnostics. Oscar is already there, piloting, improving, and growing while other insurers rush to retrofit their technology. Investors should keep a close eye on that head start.